An Easy Approach to Budgeting – Your Expense Tracker

Retirement is an exciting chapter filled with possibilities—more travel, new hobbies, time with family, or relocating to a dream destination. However, to truly enjoy retirement stress-free, knowing the cost of living comfortably is essential. The key to financial confidence in retirement isn’t about how much you’ve saved—it’s about understanding how much you need.

We previously explored How Much Money Do You Need to Retire? But before answering that, the first question to consider is what you currently spend to maintain your current lifestyle?

This is a question many people don’t have the answer to, or maybe it’s just a ballpark estimate …. how much do you spend weekly, monthly, or yearly?

Years ago, we moved away from rigid budgeting; we stopped tracking every dollar, every takeaway coffee or after-work drink. Instead, we focused on saving for our next holiday, a new car, and our future. Then one day, my better half asked, "What do you do with all this data?" That made me rethink our approach.

We stopped budgeting in the traditional sense, but we continued to track our expenses. Our goal? To maintain our lifestyle in retirement without financial surprises. See also my FIRE blog post.

Why Tracking Your Expenses Matters

Understanding your current spending habits is key to estimating how much you'll need in retirement.

Tracking expenses helps you:

Identify areas where you can reduce or adjust for retirement.

Plan for upcoming costs like travel, healthcare, or home maintenance.

Avoid underestimating expenses, as this can lead to financial stress later.

Ensure you have sufficient savings or income sources to support your lifestyle.

If you’ve never tracked your expenses before, don’t worry, it’s easier than you think! Tracking your expenses is a simple and straightforward process that can provide you with valuable insights into your spending habits.

Common Expense Categories

Here are the main spending categories to track to get a clear picture of your financial needs. They’re grouped into two categories: “Must-Have”, the essentials, and “Nice-to-Have”, those lifestyle & discretionary expenses.

Essential Expenses (Must-Have)

Housing – Mortgage or rent, property taxes/rates, home insurance, maintenance, repairs

Utilities – Electricity, water, phone, internet, streaming services

Food – Groceries, takeout/takeaway, dining out

Transport – Car loan, registration, insurance, fuel, maintenance, public transportHealth & Insurance – Health insurance, doctor visits, dental, physiotherapy, optometry, chiropractic

Household Expenses – Furniture, appliances, cleaning supplies

Clothing & Personal Care – Clothing, haircuts, beauty treatments

Lifestyle & Discretionary Expenses (Nice-to-Have)

Entertainment & Leisure – Social activities, hobbies, sports, streaming services, dining out

Travel & Holidays – Flights, accommodation, activities, travel insurance

Gifts & Giving – Presents for family/friends, charitable donations

By separating essential and discretionary expenses, you gain a flexible spending plan—you know your baseline costs and can scale back on extras if needed.

Any work-related expenses will be deducted in retirement; some costs will disappear. For example:

Commuting for work - fuel, parking, public transport passes

Work attire - suits, uniforms, dry cleaning

Work-related meals and networking events

However, you may need to increase your budget for leisure activities, such as travel, hobbies, and entertainment, since you'll have more free time.

How to Track Your Expenses Effectively

To estimate your retirement budget, start tracking your expenses now. Here’s a step-by-step approach:

Step 1: Gather Financial Data

Review your bank statements, credit card bills, and receipts from the past 3–6 months. Identify and categorise all expenses into fixed and variable costs.

Fixed Expenses – Rent/mortgage, insurance, subscriptions, utilities.

Variable Expenses – Groceries, dining out, travel, and entertainment.

Tip: Don’t forget annual or one-off costs like car servicing, medical expenses, and holiday spending.

Step 2: Choose a Tracking Method

You can track your expenses using:

Pen & Paper – A simple notebook to jot down daily expenses.

Spreadsheets – Use Excel, Google Sheets, or Apple Numbers (I’ve provided a template below).

Expense Tracking Apps – These automate tracking and often sync with bank accounts

Banking Apps – Many banks now categorise expenses and provide spending reports.

Tip: If you prefer manual tracking, use your phone’s Notes app or send yourself a quick email with daily expenses.

Step 3: Analyse Your Spending & Adjust for Retirement

Once you’ve tracked your expenses for a few months, ask yourself. Are there any unnecessary expenses I can cut or reduce? Will my spending increase in specific areas during retirement, such as travel and healthcare? Do I have sufficient income (from pension, investments, and savings) to cover my future expenses?

Step 4: Try a Retirement Budget Test

Live on your estimated retirement budget for 3–6 months while still working. If it feels comfortable, you’re on the right track! If not, adjust accordingly.

Additional Budgeting Tips for Retirement

Automate Savings & Bills – Set up direct debits for recurring expenses.

Plan for Inflation – Prices are expected to rise, so build a buffer for future costs.

Emergency Fund – Have at least 6–12 months of living expenses set aside.

Factor in Healthcare Costs – Expenses may increase as you age.

Review Your Budget Annually – Adjust for lifestyle changes and unexpected expenses.

Tip: If you plan to retire abroad, track the cost of living in your target destination and factor in currency fluctuations, tax implications, and healthcare availability.

Final Thoughts

Tracking your expenses isn’t about restricting your lifestyle—it’s about gaining financial clarity and confidence. By understanding your spending habits, you can plan a retirement that aligns with your goals and financial situation.

Whether you use a spreadsheet, an app, or a notebook, the key is consistency. The more you track now, the smoother your transition into retirement will be.

Your spending may be higher when you first retire. For example, if you plan to travel or update your home. As you get older, you may need to allocate more funds for healthcare.

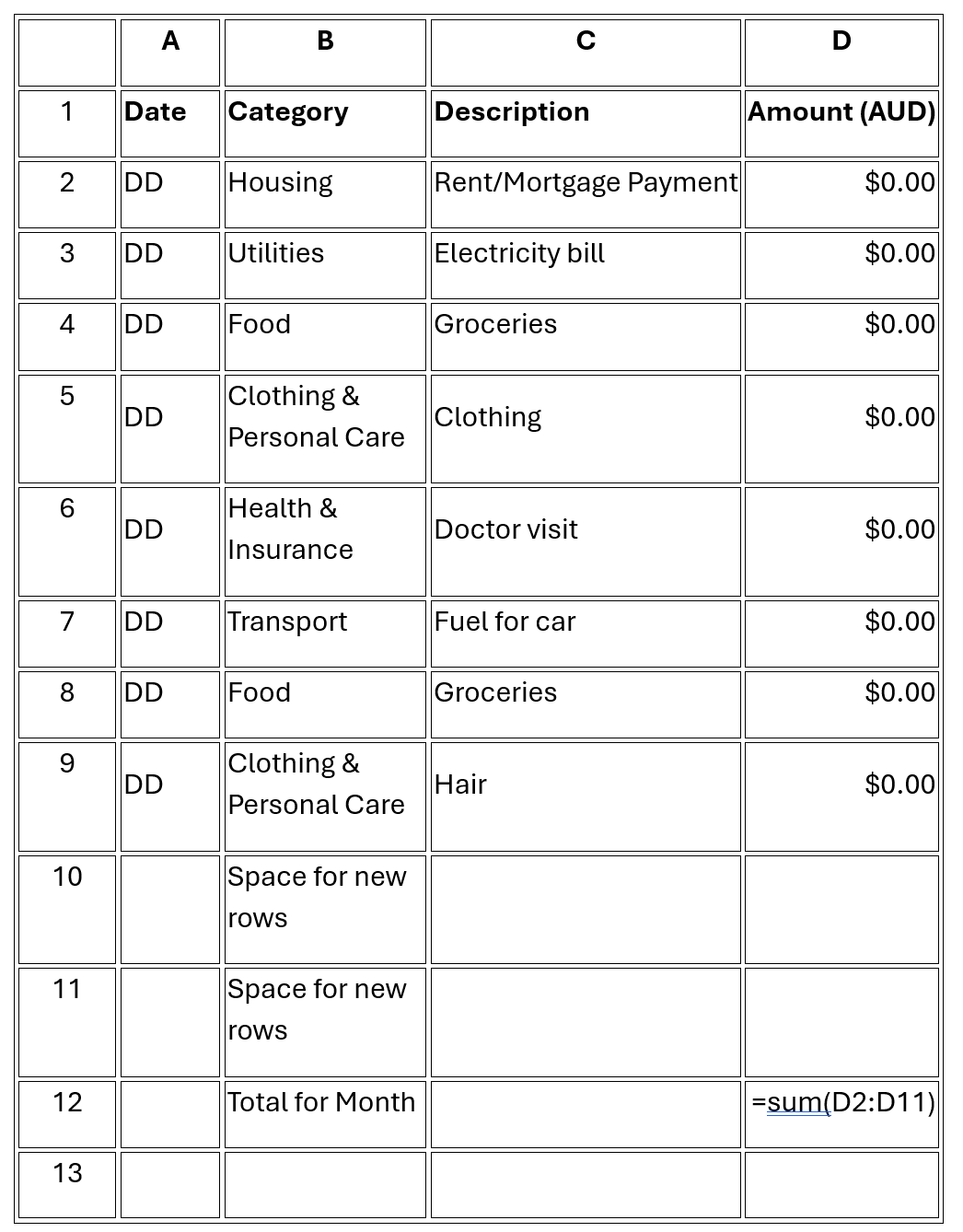

Template Example

Must Have (Essential Expenses) – Insert Month Title in tab

Note: The formula in cell D12, D2 is the first amount in the month and amend the formula to be the final row number (ie, D11)

Create a similar tab for your “Nice-to-Have” expenses.

Copy the tab and create a new tab for each month.

Tip: When using Excel, I prefer to utilise the filter function and group the category column, allowing me to view, for example, the "Groceries" category. This is how: select the menu option Data, then select all columns, then in the ribbon select Filter.